Share this

E-Invoicing in Europe: What Real Estate Finance Leaders Need to Know Now

by David Stifter on Nov 4, 2025 9:00:02 AM

Across the European Union, e-invoicing mandates are accelerating. These policies are not simply about digitization for convenience; they are designed to strengthen tax compliance, combat VAT fraud, improve transparency, and streamline reporting. The core shift is that invoices are increasingly being treated as structured data, not static documents.

For accounts payable and finance teams in real estate organizations, this shift requires more than just a software upgrade. It requires changes in process design, vendor engagement, and AP operations across portfolios, property managers, and shared service centers.

This article explains what is changing, which formats are required where, and how real estate finance teams can prepare. A follow-up article will focus specifically on invoice coding challenges in real estate, and why coding remains hard even when invoices become electronic.

Why the EU is Moving to E-Invoicing

VAT fraud and reporting complexity have long been challenges across the EU. Traditional PDF and paper invoices are difficult for tax authorities to verify in real time. E-invoicing mandates aim to solve this by ensuring that invoice data can be transmitted, validated, and stored in standardized formats, often through government-controlled systems.

Key goals of the EU e-invoicing movement include:

- Reducing VAT fraud by ensuring tax authorities can see transactions in real time or near-real time

- Improving auditability by ensuring invoices follow a standardized data structure

- Reducing administrative burden by removing manual data entry and reconciliation work

- Increasing cross-border interoperability through shared standards such as EN 16931 and Peppol BIS

Over time, e-invoicing will shift the role of AP departments from document handling to data validation and workflow oversight.

Structured vs. Hybrid E-Invoice Formats

Not all EU countries require the same type of electronic invoice. Real estate firms operating across multiple markets must be able to support both:

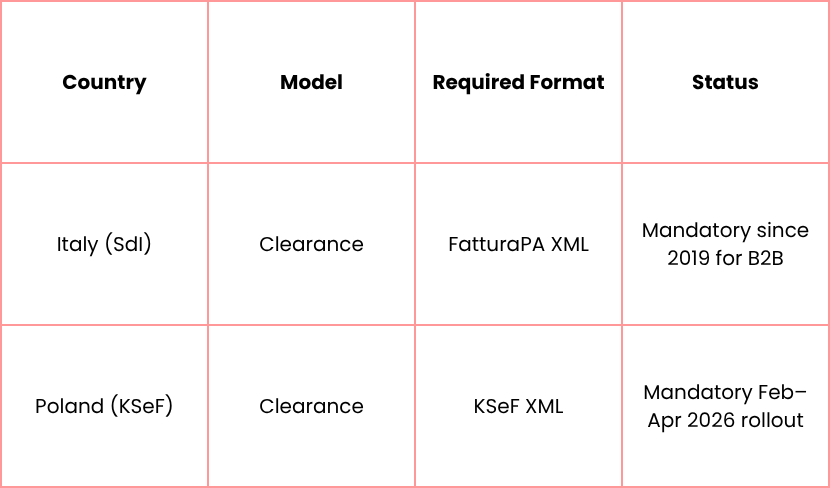

1. Structured E-Invoices (XML via Government Platforms)

These are invoices issued and transmitted in machine-readable XML formats through national tax systems.

Poland (KSeF)

- February 1, 2026 – Mandatory for large taxpayers (defined as annual revenue > PLN 200M in the prior tax year)

- April 1, 2026 – Mandatory for all other VAT-registered businesses

Invoices not transmitted via KSeF will not be recognized as valid invoices for VAT, regardless of whether they were emailed, printed, or stored internally.

Italy (SdI)

Italy’s clearance model requires all invoices to pass through SdI in the FatturaPA XML format. A PDF invoice is not considered “issued.” Failure to use SdI may result in invoices being rejected or penalized.

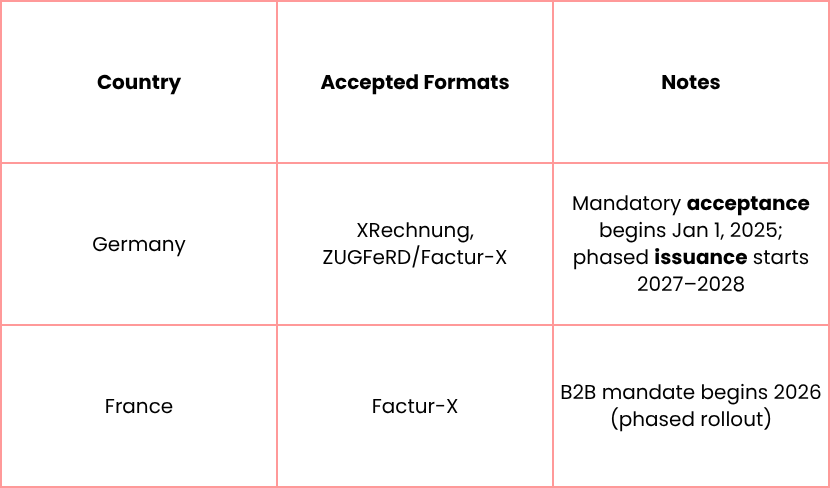

2. Hybrid E-Invoices (PDF + Embedded XML)

Some jurisdictions permit invoice formats that include both:

- A readable PDF, and

- An embedded XML file that systems can process automatically

These formats comply with the EN 16931 European data standard.

In hybrid models, the XML component is the legally authoritative invoice, while the PDF is provided for visibility and operational clarity.

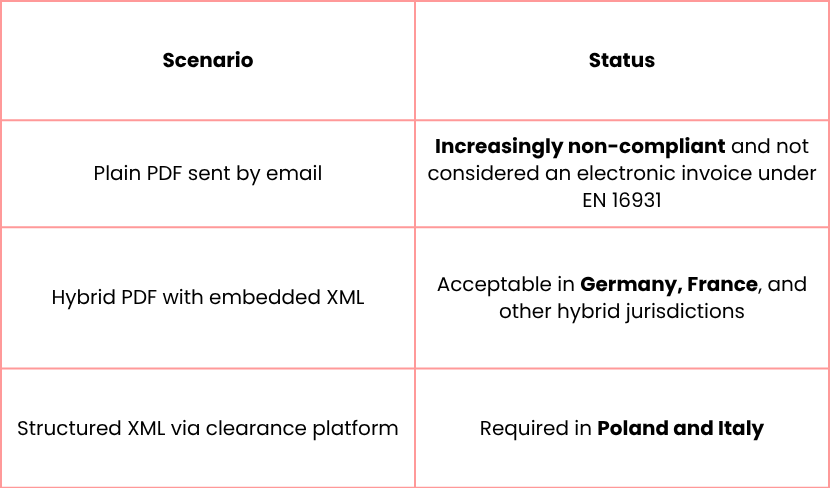

Important Contrast: Where PDFs May Still Be Used vs. Where They Cannot

Plain PDF invoices are slowly being phased out in the EU regulatory environment. Organizations relying heavily on PDF approval workflows should expect growing disruptions if they do not prepare.

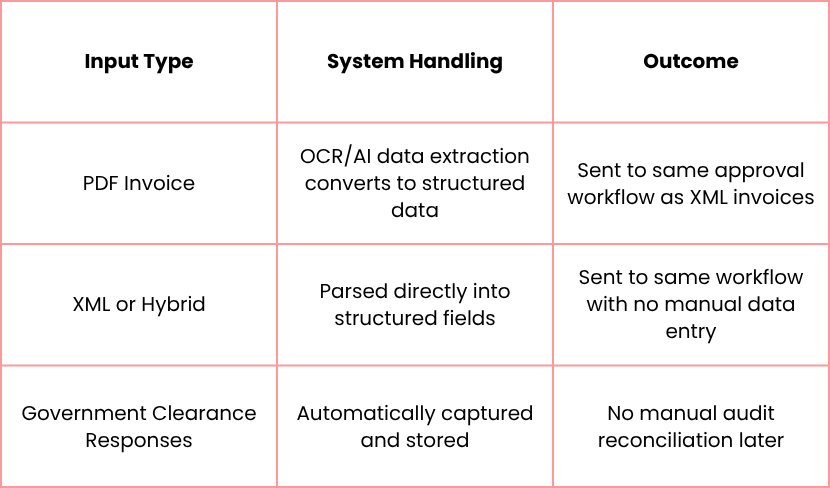

The Operational Challenge: One AP Team, Two Worlds

For the next several years, real estate finance teams will process both:

- Traditional PDF invoices (from smaller vendors who have not yet adopted e-invoicing)

- Structured electronic invoices (from vendors or mandates requiring XML feeds)

If these are handled in separate processes, AP staff will face:

- Duplicate workflows

- Increased exceptions

- Difficult training and turnover transitions

- Higher risk of invoices being delayed or lost

The Goal: A Single Unified Workflow

To avoid this, AP organizations should implement an invoice intake model where:

One Workflow Matters Because:

- Real estate organizations process high invoice volumes across many small vendors

- Property and job cost coding varies by asset, region, and management model

- Staff turnover in AP is common, so simplicity and consistency reduce training load

- Exceptions are expensive, and dual workflows create more exceptions

A unified workflow ensures AP teams spend less time processing invoices and more time reviewing exceptions and conducting oversight.

What Comes Next: Coding is the Hard Part

Even when invoices arrive in structured formats, coding remains a challenge. This is especially true in real estate, where invoices must often be split across:

- Properties

- Business units

- Chart of accounts

- Job cost categories

- Recoverable/non-recoverable classifications

Structured invoices do not solve coding complexity; they only reduce manual data entry.

But that's more than we can cover in one blog post.

Our next article will focus on how real estate organizations can automate invoice coding, reduce manual review time, and increase accounting accuracy across portfolios.

Share this

- AP Efficiency (35)

- PredictAP News (25)

- AI Best Practices (22)

- AP Best Practices (22)

- Real Estate Accounts Payable (20)

- Real Estate Industry (15)

- Invoice Coding (11)

- Customers (9)

- Invoice Capture (9)

- Accounts Payable Staffing & Hiring (7)

- Purchase Orders (3)

- Partners (2)

- Knowledge Management (1)

- Senior Living (1)

- Yardi (1)

- February 2026 (3)

- January 2026 (3)

- December 2025 (4)

- November 2025 (7)

- October 2025 (4)

- September 2025 (5)

- August 2025 (5)

- July 2025 (6)

- June 2025 (3)

- May 2025 (2)

- April 2025 (2)

- March 2025 (2)

- February 2025 (2)

- January 2025 (1)

- December 2024 (1)

- November 2024 (1)

- September 2024 (1)

- August 2024 (3)

- July 2024 (1)

- June 2024 (2)

- May 2024 (3)

- April 2024 (1)

- January 2024 (1)

- March 2023 (3)

- February 2023 (1)

- November 2022 (1)

- September 2022 (1)

- August 2022 (2)

- July 2022 (1)

- May 2022 (2)

- April 2022 (2)

- February 2022 (2)

- December 2021 (1)

- November 2021 (1)

- April 2021 (1)

- March 2021 (1)