Share this

4 Types of Invoice Capture Solutions Used by Real Estate AP

by Karo Sadowicz on May 9, 2022 8:15:00 AM

If you’ve spent any amount of time thinking about improving accounting and accounts payable (AP) processes using technology, you’ve become familiar with various AP automation platforms. These, and other platforms—many with artificial intelligence (AI) underpinnings—promise to save time using automation. Still, as more real estate CFOs and CTOs grapple with a mandate to streamline and automate AP, a frustrating gap remains in the workflow: invoice capture.

In this article, we’ll define invoice capture and examine the categories of solutions, and how they leverage a mix of services and technology to improve your AP process. We’ve included an overview, as well as pros and cons for each solution class. For readers who want better results from their current solution, we’ve included ideas on how to improve on whatever you have in place today.

What is invoice capture?

Invoice capture is the first step in the process of preparing an invoice for payment and includes invoice ingestion, invoice indexing, and invoice coding. It precedes the review workflow that enables approving and paying invoices. Unlike workflow and payment management, invoice capture still relies on mostly manual data entry.

When receiving an invoice, your AP team has to ingest and index it—this means taking data from the new invoice, whether it’s digital or on a printed page, and entering it into a system of record. It’s data entry, and many solutions address it.

Invoice coding is the process of matching invoice data to codes that specify the vendor, remittance address, general ledger accounts, expense accounts, properties, cost allocations, and other details required for routing it through the correct approval and payment processes.

As part of invoice capture, invoice coding has remained almost exclusively reliant on manual data entry.

Is invoice capture different from AP automation?

Approval workflows have been streamlined and automated with AP automation solutions like Yardi PayScan, Nexus, and AvidXchange, yielding massive time and cost savings across the real estate industry. In tandem with an ERP or system of record and a treasury system, these tools have transformed the latter stages of an invoice’s lifecycle.

AP automation solutions focus on making it easier to guide invoices to the right people and through the right steps. They deliver visibility, control, and standardization to the approval process. They also can’t be leveraged until an invoice is fully coded.

Invoice capture—and especially coding—is still mostly done manually by AP staff or property managers. Aside from the complexity of understanding account and property relationships, new invoices don’t contain enough information to allow for easy coding. The historical context required is something your team learns over time—years, months.

The 4 types of invoice capture solutions

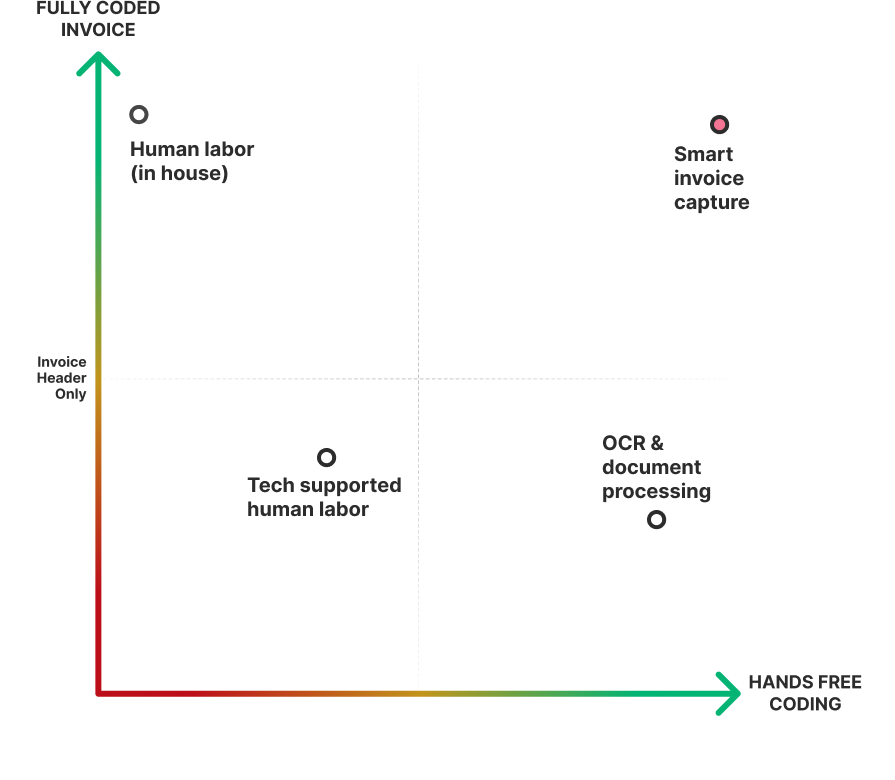

Invoice capture solutions fall into three main categories: human labor, tech enabled human labor, and automation. All provide some ability to ingest and index new invoice data.

While each comes with additional considerations and varying levels of intelligence, all should be assessed on the same criteria: coding completeness and processing speed.

Coding completeness means readiness to be pushed into the appropriate workflow for review. Completeness and accuracy reduce the likelihood of downstream corrections, extended review cycles, and missed fraud attempts.

Processing speed matters for getting bills paid on time to avoid late fees and preserve vendor relationships. It’s also essential for avoiding bottlenecks and letting invoices fall through the cracks.

Our invoice capture matrix approximates how these solution categories stack up. Read on for more details.

1. Human labor

Your in-house AP team or property management office staff are still the most common default option. They know your business, they know your vendors, and they know your process. It’s nearly impossible to improve on an experienced AP specialist, and definitely impossible to clone her. Even the most efficient invoice coders have a limit to how many invoices they can process in a week. But the bigger problem is turnover.

The combination of low pay and repetitive data entry work makes AP specialists hard to hire, train, and retain. When they leave, so does their coding expertise, and it can take months to train someone new to meaningful proficiency.

Pros:

- Well developed institutional expertise

- Familiar with your vendors and accounts

- Well versed in your process and systems

- Connected to other accounting and finance staff

- Do both ingestion and coding

Cons:

- Expensive to keep hiring and training for data entry roles

- Monotonous work leads to low job satisfaction and high turnover

- Bottlenecks at times of increased volume

- Manual data entry prone to error and inconsistencies

- No time for other priorities or higher value work

How to improve on it:

As stated before: your team is not what needs improving. But a better solution for capture and coding can make their jobs easier and empower them to get more done.

2. Tech supported human labor

This broad category includes a diverse set of solutions, but all combine services—or outsourced data entry—with sophisticated tech solutions.

One common option outsources invoice capture data entry to a lower cost labor market in another country. This removes the immediate burden from your team, but introduces challenges around both speed and accuracy. These providers will sometimes also include scanning and mailbox services, routing all invoices to a dedicated mailbox. But they also capture only what’s on the new invoice and leave coding to your team.

Portals where vendors can enter and track their own invoices are more tightly integrated with existing systems, but see low adoption rates because they displace the data entry to the vendor. While a vendor-submitted capture solution might provide some additional details, they also do not yield a complete and coded invoice.

Pros:

- Hands-free for in-house team

- Lower cost in some cases

- Well integrated into existing systems when offered through ERP vendor

Cons:

- Slow processing time

- Error prone with little ability to correct

- Doesn’t improve over time

- Low adoption for portals

- Can’t code invoices

How to improve on it:

Back office services are a great alternative for teams managing increasing volumes or efficiency challenges. These AP-as-a-service providers help offload effort from your team, but also learn and apply your coding in a more consistent way, becoming a more efficient extension of your team.

3. Document processing and OCR

Optical character recognition (OCR) has come a long way from fuzzy PDFs that started as a fax. Whether you implement a solution as part of your tech stack, or rely on a third-party document processing service, these powerful solutions shine at scale, but fail to provide fully coded invoices.

The sophistication of this solution is also their biggest drawback. Most are not focused exclusively on invoices, or real estate. Some will only work as part of their proprietary document management or pay-to-procure suite. Others can integrate with your existing systems, but require extensive custom development.

Pros:

- Fast and capable of some automation

- Scalable to high volumes

- Highly customizable

Cons:

- Lack native integration with AP automation

- Designed for broad range of applications, not always invoices

- Not real estate specific

- Lengthy implementations required

- Can’t code invoices

You get processing speed and scalability, but usually at the expense of coding completeness. The more customization is required to integrate with your systems, the longer the implementation timeline. That means waiting months before realizing the promise of faster invoice capture.

How to improve on it:

To help with accuracy and save time, some teams have implemented coding templates for common invoice types, or use purchase orders to pre-code the invoice in their system of record. Display types in Yardi can control which fields are visible to the person coding the invoice to minimize data entry errors.

4. Smart invoice capture

This emergent category aims to complete the entire invoice capture process with as little human effort as possible. It focuses on bridging the gap between ingestion and indexing capabilities and invoice coding.

A smart invoice capture solution leverages OCR capabilities for ingesting invoice data, integrates with AP automation to index invoice data in your system of record, and uses AI to code the invoice without requiring manual data entry by your team.

Smart invoice capture aims to eliminate the tradeoff between coding completeness and processing speed. The goal is to save time and effort without sacrificing accuracy—thus also lowering operational costs.

With a vision of truly hands-free invoice coding that frees up your team for higher value work, this category is poised to reshape real estate AP. As with any new solution category, features and capabilities are still evolving, and some organizations will find they are not ready to be early adopters, or have to wait on a future release for functionality they deem essential.

Pros:

- Complete invoice capture: both ingestion and coding

- Institutional knowledge retained in platform

- Eliminate monotonous manual work

- Faster processing time

- High accuracy with continuous improvement

- Scalable and bottleneck proof

- Low effort implementation without installations or custom dev

- Native integration with AP automation

Cons:

- Best suited to high volumes

- Require compatible AP automation

- Feature sets still developing

Which invoice capture solution is best for your team?

The lesson learned from a wave of AP automation implementations is that success depends on more than technology. When determining your needs for invoice capture and coding, consider your team’s unique needs and business priorities.

Here are some common use cases that can create urgency for finding a better invoice capture solution:

- Scaling capacity to manage growing invoice volumes — acquiring new portfolios doesn’t always include additional AP staff. Your existing team needs to process more invoices without adding more headcount just for data entry.

- Improving coding consistency and compliance — for distributed AP teams, or a mix of in-house and outsourced staff doing manual data entry, centralizing and codifying your invoice coding can protect against errors, noncompliance, and their downstream effects.

- Reclaiming time for higher value work — when invoice capture and coding is managed by on-site staff, it competes for time against other priorities, keeping them from property management and tenant support.

- Increasing visibility and audit readiness — as reporting and auditing demands shift for a growing business, outsourced and manual processes that obfuscate what happens during invoice capture can go from annoying blind spots to major audit risks.

Adding the right invoice capture solution to your real estate fintech/proptech stack can transform your AP process, and even improve outcomes from AP automation.

Consider your most important business pains and objectives, and how quickly you need to realize the promised benefits when making your selection.

Need to improve accounts payable efficiency? Download our new ebook!

Share this

- AP Efficiency (35)

- AI Best Practices (25)

- PredictAP News (25)

- AP Best Practices (22)

- Real Estate Accounts Payable (20)

- Real Estate Industry (15)

- Invoice Coding (11)

- Customers (9)

- Invoice Capture (9)

- Accounts Payable Staffing & Hiring (7)

- Purchase Orders (3)

- Partners (2)

- Knowledge Management (1)

- Senior Living (1)

- Yardi (1)

- March 2026 (2)

- February 2026 (4)

- January 2026 (3)

- December 2025 (4)

- November 2025 (7)

- October 2025 (4)

- September 2025 (5)

- August 2025 (5)

- July 2025 (6)

- June 2025 (3)

- May 2025 (2)

- April 2025 (2)

- March 2025 (2)

- February 2025 (2)

- January 2025 (1)

- December 2024 (1)

- November 2024 (1)

- September 2024 (1)

- August 2024 (3)

- July 2024 (1)

- June 2024 (2)

- May 2024 (3)

- April 2024 (1)

- January 2024 (1)

- March 2023 (3)

- February 2023 (1)

- November 2022 (1)

- September 2022 (1)

- August 2022 (2)

- July 2022 (1)

- May 2022 (2)

- April 2022 (2)

- February 2022 (2)

- December 2021 (1)

- November 2021 (1)

- April 2021 (1)

- March 2021 (1)